Latest Article

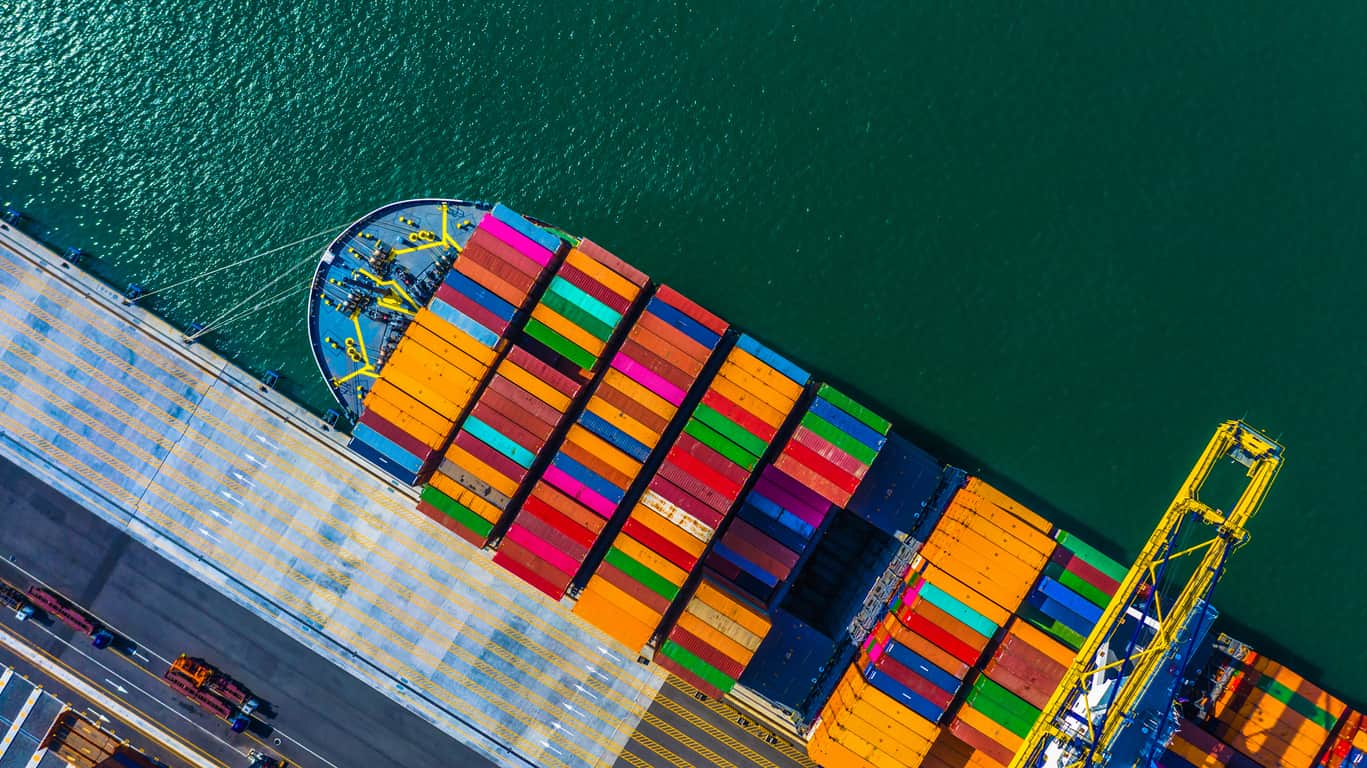

Major Victory for Customs Fraud Whistleblowers: Federal Appellate Court Upholds $26M False Claims Act Verdict, Rejecting Importer’s Defenses

The decision reinforces the pivotal role of whistleblowers in exposing customs fraud and the substantial rewards they can receive.

Current Articles

Pharmaceutical Giant Bayer Pays $40M to Settle False Claims Act Whistleblower Lawsuits Over Three Drugs

Qui tam whistleblower alleged that Bayer fraudulently paid kickbacks, conducted off-label marketing, and hid safety risks

Helicopter Flight School and Community College Pay $7.5M to Settle False Claims Acts Whistleblower Lawsuit

Pilot training program allegedly falsified enrollment figures to obtain Veterans Affairs funding

Medical Device Manufacturer Biotronik Pays $12.95M to Settle Qui Tam Whistleblower Lawsuit over Physician Kickbacks

Biotronik allegedly paid doctors illegal kickbacks to promote the sale of its implantable cardiac devices

Defense Contractor Pays $9M to Settle False Claims Act Whistleblower Lawsuit Involving Cybersecurity Noncompliance

Qui tam whistleblower alleged that Aerojet Rocketdyne misled the government regarding its compliance with cybersecurity standards

Firm Wins $24M False Claims Act Judgment, $2.7M in Attorney’s Fees, against Corporate Rival over Evasion of Anti-Dumping Duties on Chinese Imports

Importer of welded outlets knowingly evaded applicable anti-dumping duties

California Companies Affiliated with Chinese Billionaire “Uncle Liu” Found Guilty of Fraudulent Scheme to Dodge U.S. Customs Duties on Aluminum Imports, Ordered to Pay $1.8B in Restitution

Extruded aluminum imports fraudulently misclassified as warehouse pallets to evade anti-dumping and countervailing (AC/CVD) duties

Qui Tam Relators Stand to Receive Significant Whistleblower Rewards as Electronic Health Records Firm Settles False Claims Act Lawsuit for $18.25M

Athenahealth allegedly violated the Anti-Kickback Statute (AKS) and False Claims Act by paying kickbacks for clients referrals

Qui Tam Relator Receives $4.6 Million Whistleblower Reward as Boeing Subsidiary Pays $25 Million to Settle False Claims Act Lawsuit over Inflated Costs of Drone Parts

Company allegedly gave government inflated cost and pricing data when negotiating no-bid contracts for drone-related military projects

Eleventh Circuit Takes Broad View of Escobar’s Materiality Requirement, Reviving $240 Million Qui Tam Whistleblower Lawsuit Involving Unallowable Fees Included in VA Mortgage Loan Guarantees

Court takes “holistic approach” to materiality, rejecting strict focus on the ultimate “payment decision” in significant win for qui tam

Falsely Certifying Eligibility to Participate in Government Programs can Give Rise to Liability under the False Claims Act Post-Escobar, Court of Appeals Holds

Second Circuit rules that relevant government “payment decision” under Escobar included Veterans Administration’s initial decision to award contracts based on

Supreme Court of Illinois Upholds Qui Tam Whistleblower Provisions of State Insurance Claims Fraud Prevention Act

Court holds that whistleblower standing under the Insurance Claims Fraud Prevention Act—like the federal False Claims Act—does not require that

The Shield of Qualified Immunity is Unavailable as a Defense under the False Claims Act, Appellate Court Holds

Fourth Circuit reasons that proving the fraudulent state of mind required for False Claims Act liability would defeat any claim

TOPICS

- Anti-Kickback Statute (AKS) (7)

- Class Actions (1)

- Contracting & Procurement Fraud (8)

- COVID-19 Relief Fraud (3)

- Credit Assistance Fraud (1)

- Customs Fraud (32)

- Education Fraud (2)

- False Claims Act (4)

- Financial Fraud (1)

- Grant Fraud (3)

- Healthcare fraud (8)

- Insurance Claims Fraud (1)

- Qui Tam (False Claims Act) Litigation (2)

- Qui Tam Lawsuits (1)

- Tax Fraud (1)